Get First 5 Form W-9s for FREE! Request W-9 Now

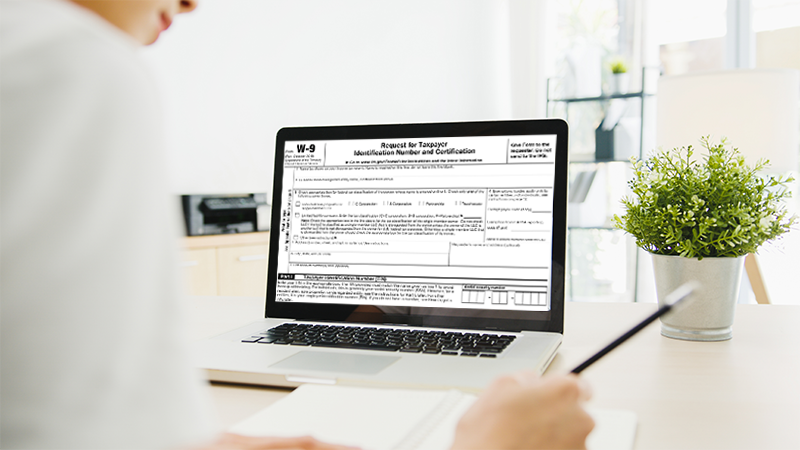

What is IRS Form W-9?

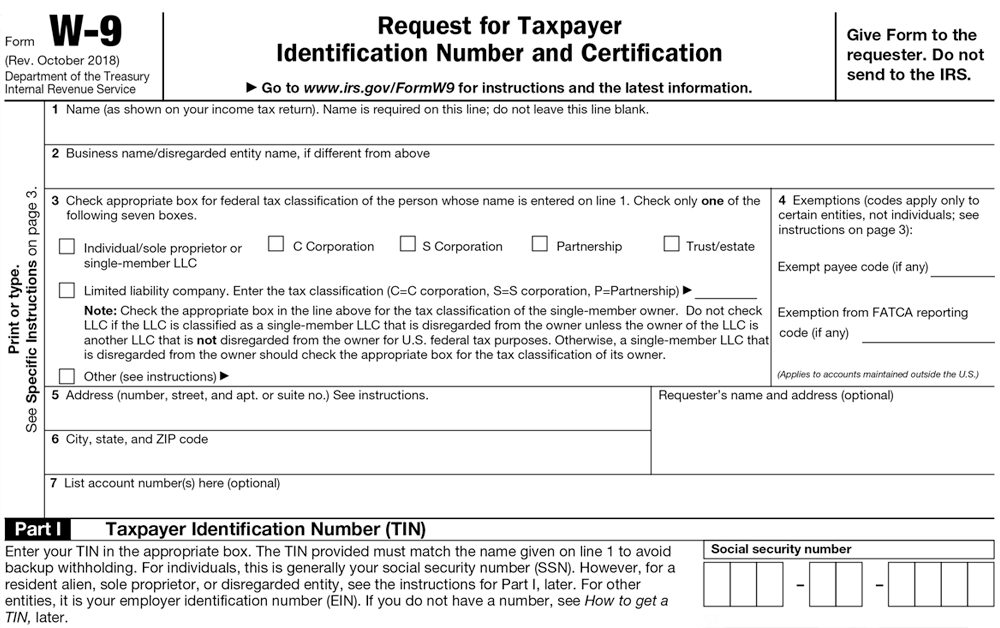

IRS Form W-9 is used by businesses to request the Taxpayer Identification Number and Certification from the Individuals, Contractors or freelancers.This information is required for businesses to file Form 1099.

If the business paid more than $600 during the calendar year to contractors or freelancers for their work should file Form 1099. To file Form 1099, Businesses need their vendors' basic details like name, business name, address and certification which are required on W-9 Form.

Visit https://www.taxbandits.com/what-is-form-w9/ to know about IRS Form W-9.

Fill Form W-9 online for Free

TaxBandits’ Fillable Form W-9 revolutionizes the way you handle your tax documentation. With our user-friendly platform, creating, filling out, downloading, and sharing your Form W-9 becomes easier than ever. Say goodbye to time-consuming paperwork and experience a seamless W-9 completion and sharing.

Here are some of the advantages on how to fill out a W-9 Form

- Quick and Convenient: Our intuitive platform streamlines the W-9 process, allowing you to complete it in just minutes.

- Cloud-Based Access: Access your Form W-9 anytime, anywhere, thanks to our secure cloud-based platform.

- Error Validation: TaxBandits performs basic validation checks on your W-9 Form to catch basic errors.

- Secure Sharing: Easily share your completed Form W-9 with the payers, whether it's your employer, client, or business partner. Our platform ensures that your sensitive information remains confidential and secure.

Information Required to complete

IRS Form W-9 Online

To Request Form W-9 Online You need following information

- Name, Business Name, Business type, Address.

- Enter TIN (EIN/SSN).

- Requester Name & Address.

Click here to get detailed instructions about Form W-9.

How to fill out Form W-9

Filling out a W-9 is quite easy by following the step by step Form W-9 instructions to complete Form W-9.

- Line 1 - Enter your Name, it should match the name on your individual tax return.

- Line 2 - This line is optional. Enter your Business Details

- Line 3 - Mention your business entity type and enter the federal tax classification. If your business classified as S-Corporation, enter the letter ‘S”

- Line 4 - Exemptions (Backup withholding and FATCA Reporting)

- Line 5 - Address

- Line 6 - City, State & ZIP Code

- Line 7 - Account Number

-

Part I -Taxpayer Identification Number (TIN). The TIN provided must match the name given on line 1 to avoid backup withholding.

- For individuals, this is generally your social security number (SSN).

- For other entities, it is your employer identification number (EIN)

- Part II - Certification (Signature & Date)

Completing the Form W-9 is simple with TaxBandits!

About irsformw9.com

irsformw9.com is an online solution provider that allows you to request Form W-9 Online easily and securely.

TaxBandits offer a solution for payers to request their payees to complete W-9 from anywhere and at any time. Once Payees complete W-9 through the TaxBandits portal, payers will be notified instantly and they have the option to review, & approve W-9 Forms.

Advantages of Getting Started with Our Application

Form Validations

Real-Time Notifications

Review and Approve the

Form W-9

1099 E-filing

Online Access for

Recipients

Postal Mail 1099

Copies

Steps to Complete IRS Form W-9

Complete your IRS Form W-9 in just 4 steps

Choose Form W-9 & Add Payer Details

Invite your vendors via Email

Vendors can fill out & e-Sign Form W-9

Review and approve their Form W-9 Copy

Visit https://www.taxbandits.com/request-form-w9-online/ to know more.

Frequently Asked Questions ?

Individuals will be subject to backup withholding, if they:

- Didn't furnish the TIN to the requester

- Didn't certify your time at right time

- Didn't furnished the correct TIN

- Didn't report all their interest and dividends

- $50 - Failure to furnish their TIN to the Payer

- $500 - For false information with respect to Withholding

- Civil and Criminal Penalties for Misuse of TIN.

.png)